are union dues tax deductible in ny

As a result of the legislation passed and signed into law in April 2017 union members in the state of New York will have the opportunity to deduct their. And we were successfulBeginning this year union.

Union Dues Are Now Tax Deductible Foa Law

In a first of its kind move New York law makers have made union dues fully tax deductible.

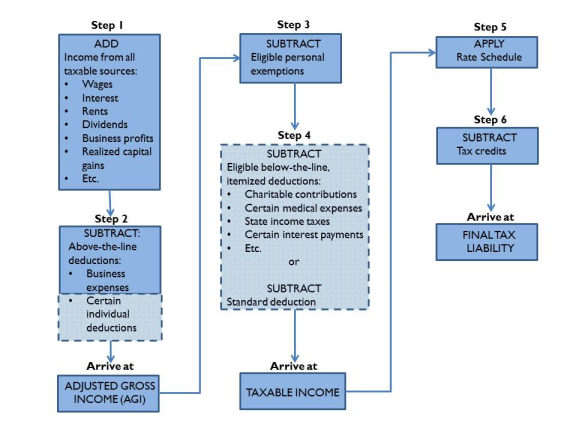

. As a result of the legislation passed and signed into law in April 2017 union. Tax reform changed the rules of union due deductions. For federal purposes your total itemized deduction for state and local taxes paid in 2021 is limited to a combined amount not to exceed 10000 5000 if married filing.

By Isabel Blank September 7 2022 News. If your Standard Deduction. Dues fully deductible from state taxes.

Tuesday March 19 2019. Unfortunately while union dues are technically 100 deductible this year they are only such if you Itemize your returns on your New York state return. Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union.

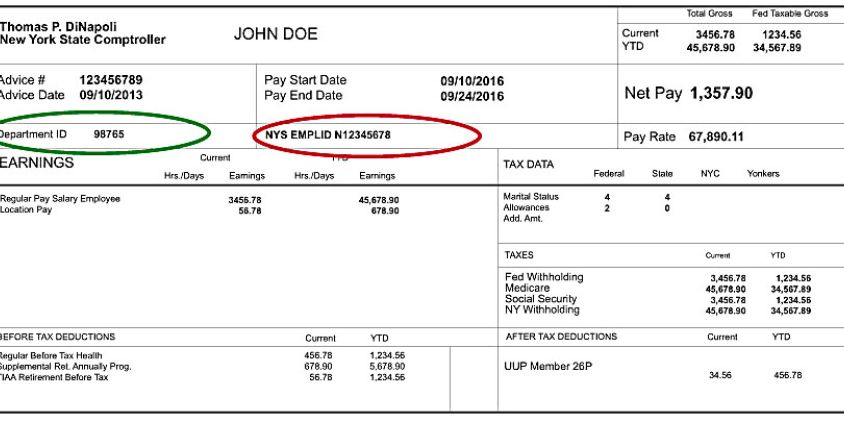

The Tax Fairness for Workers Act has been proposed to reinstate deductions for union dues and other employee expenses that are not reimbursed such as travel expenses and expenses for. The union dues will automatically be transferred over to your IT-196 which is your resident nonresident and part-year resident itemized deductions form onto line 21. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can.

In the new state budget agreement unions lobbied for and won a provision that will allow private- and public-sector. A reminder for tax season. The FY 2018 Enacted Budget creates a union dues deduction for New York taxpayers who itemize deductions at the state level equal to the amount currently disallowed at the federal level due.

As a result of the legislation passed and signed into law in April 2017 union members in the state of New York will have the opportunity to deduct their union dues from their state income taxes. The new measure was signed by New York Governor Andrew Cuomo. Two years ago the New York State AFL-CIO with support from unions across the state led the charge for this legislation.

Californias proposed Workers Tax Fairness Credit would be the countrys first tax credit for union dues. In a first of its kind move New York law makers have made union dues fully tax deductible.

Why All Workers Should Be Able To Deduct Union Dues Center For American Progress

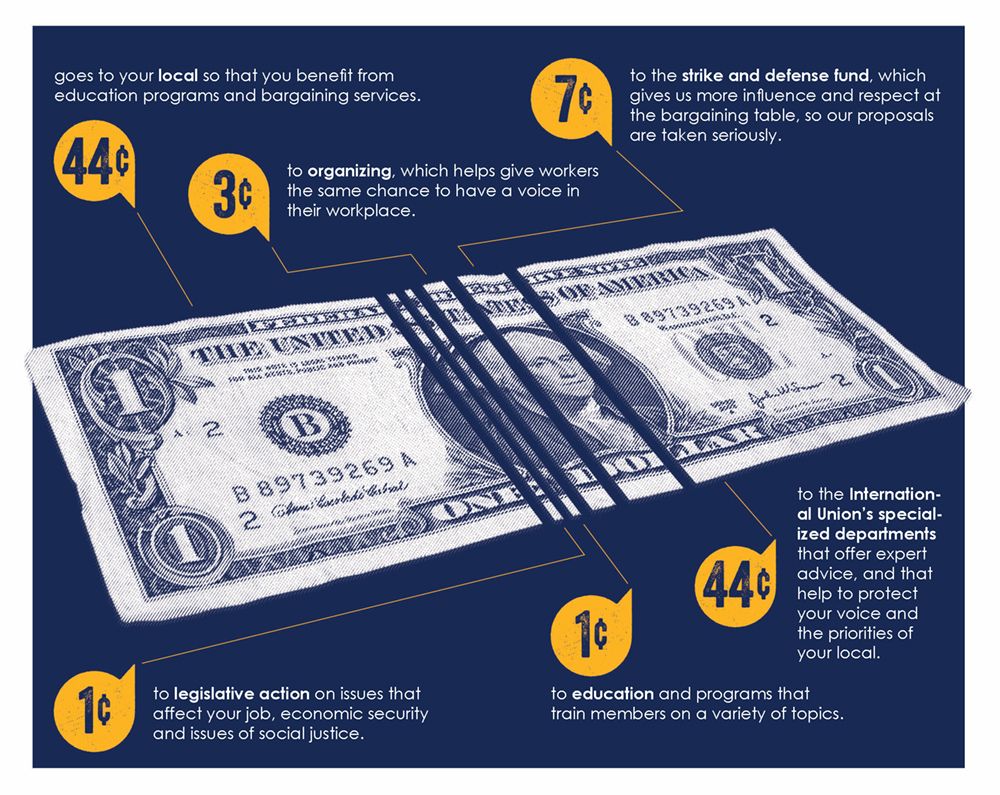

What S Expected If I M Paying Union Dues

Deductions Are Now More Limited The New York Times

New Opportunity To Deduct Your Union Dues At Tax Time New York State Nurses Association

Ny S New Tax Break For A Few Empire Center For Public Policy

Tax Deductions For Individuals A Summary Everycrsreport Com

Taxes For Actors 2020 Deductions Deadlines More Backstage

Union Representation Faculty Handbook Purchase College

Deduct Your Union Dues At Tax Time New York State Afl Cio

Dues Fully Deductible From State Taxes

Tax Time Remember These Deductions Your Union Won For You

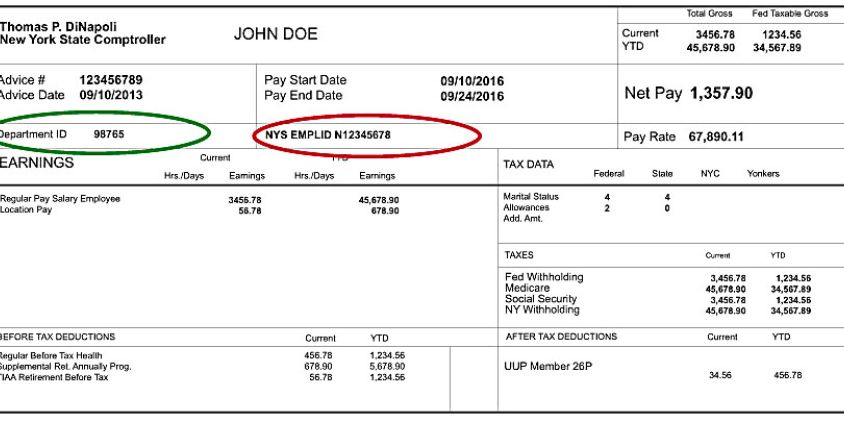

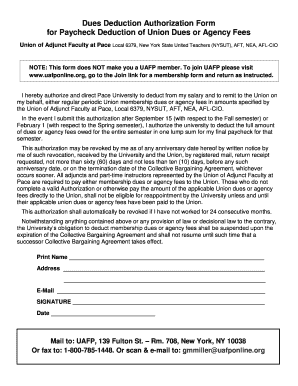

Fillable Online For Paycheck Deduction Of Union Dues Or Agency Fees Fax Email Print Pdffiller

Solved Can We Still Deduct Electrical Union Dues And The Additional Work Assessment Fees That We Used To Itemize On Either Our Federal Return Or On The Minnesota Return

Deductions Available To Educators When Filing Taxes

Deduct Your Union Dues From Your New York State Income Taxes Hotel Trades Council En

Union Dues To Be Deductible From New York State Taxes Spivak Lipton Llp